Economists spend a lot of time thinking about the gains from trade a perhaps not enough considering the losses. Creative destruction not only wipes away quasi-rents from innovation and market dominance but returns to human capital and possibly infrastructure as well.

Suppose that a worker has built 20 years of human capital in the manufacture of textiles. He knows everything there is to know about the types of cloth; machines; work train-up times need to produce fabric. He even has an intuitive knowledge of his factory and the way it responds to increased workloads, weather changes, even athletics. Workers in his town are riled up when regional football team is hot and he knows how to translate that into increased productivity.

Partially as a result of this human capital the factory he works in is among the most productive in the world and despite the fact that it pays high wages it has been competitive in the global economy. Yet, now the removal of some of the last trade barriers has tipped the equation in favor of an Indian firm. The rival is not nearly as productive as his firm. The workers require twice the raw materials and three times as many man-hours to produce the same fabric.

Yet wages are so low in India the rival firm has taken the edge and his shop is about to be closed. Everything that he has learned, has devoted his life to for the past 20 years is now gone, worthless in the new economy. He is adjustment cost. He is life is the deconstructed portion of creative destruction.

This is not a plea for protectionism but for awareness. The very same dynamic market that makes the human capital possessed by 25 year-olds in Silicon Valley worth six-figures makes the human capital possessed by 45 year-old factory foreman worth next to nothing.

In a world were productivity is determined primarily by physical capital these concerns are less important physical capital employed in sectors where the nation has a comparative advantage adds to the productivity of workers where they can benefit the most. However, in a world run by non-reversible, appreciating (reverse depreciation) human capital removal of an industry represents a permanent loss.

When I have more time I want to formally model what happens to individual welfare in a world where human capital is appreciating (on the job skill building) and a new trading partner is established that eliminates an old sector. My guess is that trade is still a net bonus though the effect is significantly mitigated and there is a strong redistribution in favor of human capital heavy participants in the sector with a comparative advantage.

Saturday, November 25, 2006

Losses from Trade

Posted by

Karl Smith

at

11:10 PM

0

comments

![]()

Refundable Credits as Negative Income Tax and Pigouvian Tax in One

A recent study, highlighted by Mankiw, has caused me to think more about the idea of refundable credits. In the Seattle area 275 households were give road toll credits. Money was deducted from their credits based on how they drove and what they didn’t use they got to keep as cash. This is in effect a Pigouvian tax in reverse. The government is paying you to refrain from a harmful activity.

For this small scale study the participants were paid to induce them to actually go along with the study. Yet, this method might have some merit out in the real world. The objection to many Pigouvian taxes is that they are likely to be regressive. There is no particular reason to think that wealthier people drive much, much more than poorer people and so the poor seem to be unfairly disadvantaged if you simply tax driving.

My response has been to rebate the money in the form of increases to the Earned Income Tax Credit (EITC). Commentators such as Mankiw would prefer that we used the extra funds to deal with the serious issue of the looming fiscal crisis. While this issue is important I fear that this method is not going to get far. Inequality is already increasing and government measures to exacerbate inequality are not likely to be popular.

In fact, I believe that we can take pro-market measures to address widening inequality today or we can wait and have anti-market measures forced down our throats tomorrow. I think that it is not completely ridiculous to compare the two-tiering of American society today with a famous two-tiering that took place within another economic superpower power a little over 200 years ago. And to misquote Oscar Wilde, we all know how that unfortunate situation ended.

So we could tax pollution and congestion and then rebate the money back to poorer families, or we could give poorer families money and then tax some of it away for pollution and congestion. The latter seems quite a bit more palatable. Now in practice we probably can’t target the funds directly towards poorer families. Every household will have to get a congestion and pollution credit equal to perhaps several thousand dollars. We could determine the exact amount by number of licensed, insured drivers or something like that. As an aside this is a great way to encourage everyone to be licensed and insured.

Then we tax the credit back out based on how much you drive. If you go over then you have to pay the difference or you get your license revoked. My guess is that the real drop in driving will occur among the poor. Many Americans will just let their credit get taxed back and maybe pay a little extra. However, those with the lowest incomes will be the most motivated to find a way to keep their credit.

In the end we end up closing some of the income gap and having cleaner, safer streets, all without a single regulation. Ain’t markets grand?

Posted by

Karl Smith

at

11:45 AM

0

comments

![]()

Tuesday, November 21, 2006

Class Struggle?

The graph above is real corporate profits (blue) compared to real worker compensation (pink). In America’s heyday, the 1940s – 1960s the two moved together in almost lockstep with corporate profits at about a fifth of worker compensation. Then in the 1970s compensation growth began to outstrip profit growth.

In fact, it seems as if you can just see them start to really diverge in 1973, the year economists often point to as the beginning of the era of diminished expectations. Corporate profits begin to trend down while worker compensation trends up. During that period, however, average real worker compensation had already begun to flatten out. The growth in compensation is, therefore, probably due to an increase in the size of the workforce during the 1970s.

The interesting thing is that movements in corporate profits seem to lead movements in compensation. When corporate profits experience a downward cycle, compensation flattens out or in a few cases even shrinks. The two are linked and broadly speaking what’s good for the worker is good for the company and vise-versa

The run-up in corporate profits during the 1990s lead the spike in compensation we all remember so well, and the gargantuan trough, beginning in the late 90s interestingly, lead the rough times we’ve seen over the last few years. Yet, corporate profits have rebounded sharply and perhaps compensation will soon.

Posted by

Karl Smith

at

7:10 PM

0

comments

![]()

Monday, November 20, 2006

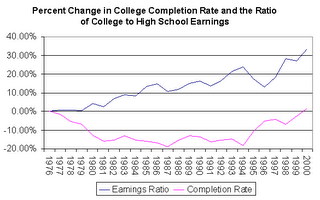

Why Increasing Returns to Education are Not a Good Sign

crust.

In either care, however, the increase is not a welcomed signed. Why?

Because, wages don’t come from average product they come from marginal product. That is, we are paid based on how dearly the market wants one more worker just like us. If the gap in wages between college educated and high school educated workers is growing rapidly this is sign that the market is not getting what it wants.

That is the economy would be stronger, growth more robust, technology more advanced, if we had more college educated workers, but we don’t. The market tries to correct this by raising the wage and encouraging more people to finish college, yet until recently more people weren’t finishing college. Now the college completion rate is up but still not by much.

Perhaps more interestingly the gap is seems to be growing because Generation X is starting to reach its high earning years. In the period after the Vietnam War college-going actually declined despite the fact that the returns to college were increasing. Indeed as Card and Lemieux point out, high returns to education seem to result not from strong increases in the demand for skilled workers but in lower supply.

In other words, we are not seeing an increase in the return to education solely or even perhaps even primarily because our advanced economy demands such a highly educated workforce but because our educational system fails to produce a highly educated workforce. It is important to remember that the most vital input to college success, a good K12 education, is not in most cases provided by the market.

Therefore, there is no reason to suspect that we are getting an optimal production of K12 education. Indeed, there are many reasons to suspect that the increasing return to education means that we are producing at a substantially suboptimal level.

This is not a cry for increased funding at the K12 level or drastic measures to curb salary increases among the well educated, but it is a warning about what may be a deep problem in our country.

If the benefits to education are rising but we aren’t getting more educated workers then there must be high marginal costs to education for some of citizens. Understanding the nature of these costs is imperative.

Posted by

Karl Smith

at

5:35 PM

2

comments

![]()