Barry Rithotlz says that the FED chooses to use the core so that it can ignore the fact that inflation has been anything but contained over the last decade. Food and Energy is where the real inflation is but the FED has blinders on.

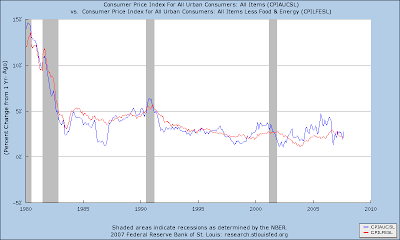

To look deeper at that theory I have both the CPI Core and Headline (top panel) and the PCE Deflator Core and Headline since 1980 when Paul Volker took the helm and the FED got serious about inflation.

There are at least three things to note.

1) The core, especially in the PCE series, seems to behave like a core, in that is cuts through the ups a down of the headline rate.

2) There were periods in the 1980s when the core was consistently above headline inflation.

3) The real aberration occurs around about 2004-2005. Judging from the general behavior you would expect the headline to dive below the core again. But it doesn't, it jumps up and continues its see-saw pattern at a higher level.

That coincides with both Katrina and the general realization that there was going to be no easy way out of Iraq. Both of those events tightened the market for energy and we have experienced a sustained increase in the price of energy that is not clearly supported by market fundamentals.

This seems like precisely the kind of thing that the FED should not be jumping at.

Tuesday, October 30, 2007

Is the Core a Ruse?

Posted by

Karl Smith

at

10:54 AM

![]()

Subscribe to:

Post Comments (Atom)

5 comments:

While I admire your tenacity in trying to explain inflation to Ritholtz, might I suggest some other more productive activites. Banging your head against a brick wall, for example.

What I want to try to understand is the rate that prices are actually rising by.

That leads to more and more questions: what do we measure? What don't we measure? How do we measure it?

I get my panties all in a bunch when people tell me either prices aren't rising, or that we should only measure these items in basket A, but not basket B . . .

~~~

Hey Steve -- after repeated blows to the head against a brick wall (i.e., blunt head trauma), one can quite easily conclude that there is little if any inflation.

But as I discussed this morning, speak to a handful of small business owners, and they will set you straight on actual (not abstract) price increases.

How about a graph of CPIAUCSL - CPILFESL over the past 10 years, or a graph of PCEPI - JCXFE? Surely over a 10 year period we should expect the net to be roughly zero. Shouldn't we?

We have a structural reason why core inflation is bogus at present. With the development of the LDCs, we have disproportionately greater excess demand for food and energy. That's not stopping anytime soon, because their energy and food intensiveness is nowhere near developed world standards.

Perhaps as a test you could compare a trimmed mean or median CPI/PCE, which are more statistically robust ways to estimate central tendency.

minute sites -

musclegainingsecrets -

muscle gaining secrets -

negative calorie diet -

one minute cure -

one week marketing -

pc on point -

pc tv 4 me -

perfect optimizer -

php link cloaker -

pick the gender of your baby -

profit lance -

public records pro -

quit smoking today -

recipe secrets -

reg clean -

regi cleanse -

registry easy -

registry winner -

reg sweep -

reverse mobile -

reverse phone detective -

richard mackenzie direct -

rocket piano -

rocket spanish -

satellite tv to pc -

smtp 2 go -

spam bully -

spyware nuker -

the bad breath report -

thedietsolutionprogram -

the diet solution program -

the stop snoring exercise program -

the super mind evolution system -

Post a Comment