I would cut 25 bps and and here is a quick not well edited sample statement:

The Federal Open Market Committee decided to lower its interest rate target to 4-1/4 percent.

Recent data suggest that economic growth has been solid and that employment growth remains strong. However, since the committee's last scheduled meeting conditions in financial markets have deteriorated, approaching levels present this summer. In addition, the ongoing correction in the housing market and the associated disruptions in the market for subprime mortgage backed securities threatens the outlook for growth.

Core inflation has continued to moderate as expected though commodity prices have remained elevated and the committee judges that some risks to inflation remain.

While risks to both inflation and output remain the committees predominate concern is that further weakness in financial markets will lower the outlook for growth. While today's action reduces the risk for further financial deterioration the committee will continue to evaluate data as it becomes available.

In a related action the Board of Governors unanimously approved a 25 basis point decrease in the discount rate.

The language here is meant to give room for another move in the discount rate in late December or early January should things fall off a cliff. The worry is that the Fed needs some tool to calm the market if and when things start going bad without spooking them because of unexpected Fed action.

With this we can set up a one-two punch, 25 bps here and a possible cut at the discount window around the new year. The hope is that will get things functioning back to normal. Its going to take some time for exports to come to the rescue but if we can keep the bottom from falling out until next summer I think we have reasonable shot at making this a mild recession.

The worry of course is with some securities going from AAA to worthless (yes, I don't mean junk or even default I mean nothing, nada, not a dime, no recovery whatsoever) in less than a year its hard to see how there aren't some significant freeze up in credit markets.

Tuesday, December 11, 2007

25 bps

Posted by

Karl Smith

at

10:32 AM

4

comments

![]()

Sunday, December 9, 2007

Where I Spit Out My Evening Tea

I am sure most of you have seen this but are you kidding me!

I've never said all tax cuts pay for themselves. I never even said Reagan's tax cuts would pay for themselves."

Arthur Laffer

HT Mankiw

Posted by

Karl Smith

at

10:26 PM

4

comments

![]()

Here We Go Again

Looks like UBS may deliever some more write downs on subprime. Will more banks and brokers fess up on fourth quarter before Christmas? If so the probability of a Santa Claus rally is slim.

Hat Tip to Caluculated Risk (the best real estate blog by far)

By the bye I am looking for 25bps from the Fed this week, but who isn't. I'll try to get in my mock statement before tomorrow is up. End of the calendar year is a busy time in the ivory tower.

Posted by

Karl Smith

at

10:02 PM

2

comments

![]()

Thursday, December 6, 2007

Oct All Over Again

Mike asks if the ADP report reduces the probability of a cut.

Well, the word about the blogosphere is that ADP has some issues with its November forecast. I have not looked into to it, but it seems Nov is always an outlier. The question is what number we get on Friday.

Another issue is the market response. I had been thinking of a post on the "Long Bear Case"; the possibility that we could see an inflation adjusted decline in US equity values well into the next decade. The sell off in the market prompted me not to hold off, so as not to be overly alarmist.

However, I think it is equally important to think about whats happening now. The current run up feels like Oct all over again. Then talk was ripe that we had priced in this whole subprime mess and could get on with the business of going upward.

I think this is unlikely. My guess is that things are likely to get worse. Significantly worse. There will be more write downs in the forth quarter and consumer spending will start to sting in early to mid 2008.

The decline in housing prices will steadily weaken the consumer because most of the pain comes through credit constraints. That is households stop spending because the bank stops lending money, not because they simply "feel" poorer.

Indeed, the "smart" household is loading up their HELOC now. Money is only likely to become harder to come buy and who really thinks the prime rate is headed up from here? If you want to buy it, you'd better buy it now. That's what the mortgage brokers are going to be selling and they are correct.

To me this means that consumer weakness is going to become much more pronounced next year than it is this year.

Posted by

Karl Smith

at

12:47 PM

4

comments

![]()

Wednesday, November 28, 2007

Losses = Lessons Learned?

In Oct. I was concerned that a rate cut could lead to an erosion in Fed credibility. The way I saw it the Fed had to options: hold firm and signal more easing or cut and signal that the easing cycle was over. I prefered the former, the Fed chose the later.

Now, it seems that their decision may be coming back to haunt them. As many have pointed out the situation has detoriated and there is strong reason to ease again in December. I tend to support antoher quarter point cut at this point.

However, what does it say about Fed credibility and foresight that just weeks ago they signaled that the cycle was ending and now it may be begining anew?

On the positive side, though, massive losses by the banks and brokers have loosened some of the concern about moral hazard. With record right downs it is hard to argue that the financial markets have not been forced to account for the excess of the past five years. This is good news for those hoping for more cuts.

Posted by

Karl Smith

at

10:24 AM

19

comments

![]()

Friday, November 16, 2007

Bear Hawk(ish)

I find myself in a unique position among econo-commentators. On the one hand I am bearish about the medium term prospects for the US domestic economy. On the other I am not yet convinced that this demands large cuts in the funds rate.

First, the bear case. It is difficult to imagine a scenario under which domestic consumption does not experience a significant slowdown over the next 18 months. To wax nerdy for a moment the structured finance revolution that gave birth to the housing boom was akin to a massive technological advance for the US, or so we thought.

It seemed as if considerable amounts of risk could be redistributed and managed for much lower costs than in the past. Risk drives a wedge between the interest rate that borrowers are willing and able to pay and the rate that lenders are willing to accept. A reduction in risk means that there are a whole host of new transactions that are now possible.

Like the internet bubble, however, the credit bubble was based on over optimistic assumptions about the power of this technology. Incidentally, the credit bubble was also sparked by large increases in computing power, but that is another story.

The upshot is that even if consumers feel no wealth or collateral effects from housing their borrowing capacity will be reduced.

In addition, we have a number of traditional forces at work. Banks are seeing huge losses on their balance sheets which will lead them to reduce lending. Consumers are facing a decline in home equity which will reduce the collateral they have to post against loans. And, finally people will at least feel poorer as a result of declining housing prices. All of these forces work against consumer spending.

So in the face of all of this why am I not advocating massive rate cuts? Part of the problem is Fed credibility. We experienced a good bit of pain in the early 80s and 90s to get the inflation rate down. The willingness of the Fed to risk those episodes did a lot to promote credibility on the inflation front. I would hate to see all go down the drain now.

Relatedly there is the issue of growth in the rest of the world. It is that growth that is creating inflation pressures, and it is also that growth which has the potential to provide some support to the US economy.

Net exports are surging and will probably continue to do so as domestic consumption slows, foreign consumption rises and the dollar shrinks. Whether or not net exports can prevent the US from sliding into recession is an open question. I tend to doubt it, but the jury is not in yet.

What does occur to me, however, is that by charting a relatively steady course the Fed will allow the trade deficit to unwind in an orderly fashion. Cutting rates aggressively generates a lot of uncertainty.

On the one hand basic theory predicts that a lower funds rate would depress the dollar further and push up net exports. On the other hand, easier money could alleviate consumer pressures, increase US domestic profits and lift the dollar on rising equity values.

If we experience the first case we risk seeing the dollar fall off a cliff. If we experience the second case we suspend the dollar ever higher against fundamentals. The steady but seemingly controlled decline we are experiencing now seems to be working and I don't see why we would want to mess with that.

We keep domestic inflation very low, we let rising commodity and import prices play themselves out. We allow the trade deficit to correct itself through lower US consumption, a weaker dollar and growth overseas.

The result will be a painful course correction for the US economy, but a much needed one that will put the global economy on a more sound footing.

Posted by

Karl Smith

at

11:08 AM

3

comments

![]()

Tuesday, November 13, 2007

Is Wal-Mart Driving the Trade Deficit

KNZN asks why Europe doesn't have a growing trade deficit.

After all, the euro is surging against the Asian currencies and Asian manufacturing is only getting more productive. If exchange rates and productivity are central to explaining the Asian export story then why isn't Europe more in the hole.

A theory, for which I have as of yet developed no empirical support, is that Asian productivity is not at the heart of this story, nor exchange rates.

The key is US productivity - US retail productivity in particular.

See, economists not only fall into the trap of immaculate transfer, the notion trade deficit magically go away when national savings exceeds domestic investment, but also the trap of immaculate delivery.

In other words, we assume that all that needs to happen is for foreign goods to be produced relatively cheaper than domestic goods and then they will magically be consumed. The problem is that the goods have to get from the foreign country to our living rooms. Somewhere in that process comes retailing.

Retailing is possibly important because we have seen massive increases in productivity over the last 15 years in retailing, with Wal-mart leading the way.

Lets assume the following example:

Suppose that originally an America toy costs roughly $5 to make and $5 to distribute and retail for a total of $10.

Now, you could get a Chinese toy stateside for $1. That means it retails for $6. However, its a piece of crap and it costs about 60% of the the American toy. With the two relatively close in price and both somewhat expensive you might as well opt for the American toy.

Enter Wal-Mart. Efficiencies in distribution and inventory management cause retailing margins collapse so that the it costs only a $1.20 to distribute and sell the toy (gross margin on the American toy falling from 50% to 20%) .

The American toy now retails for $6.20, which is a great deal. Yet, the Chinese toy retails for $2.20. It may be crap but at $2.20 why not just get it!

In this case whats happening is not that Chinese imports are getting cheaper themselves but they are getting relatively cheaper because retailing costs are falling. Just like the well known result that rising excise taxes shift consumption towards more expensive items, falling retail costs will shift consumption towards cheaper items.

What does this have to do with Europe? Well Wal-Mart and big box retailers have been considerably less successful there.

Posted by

Karl Smith

at

12:38 PM

35

comments

![]()

Thursday, November 1, 2007

Why up is really down

A few people are questioning whether its strange that surging oil price could led to falling domestic inflation?

It is a little strange at first but the answer is simple.

From a consumers point of view gasoline prices were pretty flat. So the gasoline price change is 0%.

We get gasoline by refining foreign oil here in the United States. So

Foreign Oil + Domestic Refining = Gasoline

However oil prices went up 10%. And gasoline prices stayed the same, So

10% + X = 0% =>

X = -10%

Or domestic refining prices fell by the equvialent of a 10% increase in the price of oil.

That has to be true or else the increasing price of oil would have caused increasing gasoline prices. If something is going up and the total is staying fixed then something else must be falling. That something else is domestic refining.

Now what does this mean for GDP?

Not much. The higher oil prices made our domestic refining seem more efficient which would tend to boost GDP. Yet, the higher oil prices also lowered our net exports which decreases GDP. The two effects cancel out.

Posted by

Karl Smith

at

10:10 AM

6

comments

![]()

Wednesday, October 31, 2007

Fed Cuts - Bond Rates Gap Higher

The Fed chose to cut and the immediate response is a sell off in the long bond markets. With the GDP and ADP reports where they were my guess is this cut dealt a substantial blow to the FEDs inflation fighting credibility and that ironically those looking to refinance into 30 year mortgages my find it more difficult.

Posted by

Karl Smith

at

1:24 PM

2

comments

![]()

A Cut on These Numbers????

My fellow bloggers have repeatedly said that the looming recession is "worse than expected." I am not sure what tea leaves they are reading.

Perhaps, they mean that housing is collapsing faster than estimates? But, we knew that would happen didn't we? All forecasting models assume that the future will be like the past. Yet, no person seriously thought this future would be like any past that we've seen. Underperforming the models was to be expected.

What wasn't expected was the increase in new jobs, surging GDP and consumers with their credit cards out in force.

A cut on these numbers is downright irresponsible and could ironically make long term rates go up on justifiable inflation fears.

No cut today. Perhaps, no cut in December. We need to see some slack first.

Posted by

Karl Smith

at

8:41 AM

2

comments

![]()

Tuesday, October 30, 2007

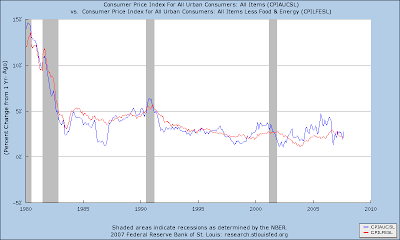

Is the Core a Ruse?

Barry Rithotlz says that the FED chooses to use the core so that it can ignore the fact that inflation has been anything but contained over the last decade. Food and Energy is where the real inflation is but the FED has blinders on.

To look deeper at that theory I have both the CPI Core and Headline (top panel) and the PCE Deflator Core and Headline since 1980 when Paul Volker took the helm and the FED got serious about inflation.

There are at least three things to note.

1) The core, especially in the PCE series, seems to behave like a core, in that is cuts through the ups a down of the headline rate.

2) There were periods in the 1980s when the core was consistently above headline inflation.

3) The real aberration occurs around about 2004-2005. Judging from the general behavior you would expect the headline to dive below the core again. But it doesn't, it jumps up and continues its see-saw pattern at a higher level.

That coincides with both Katrina and the general realization that there was going to be no easy way out of Iraq. Both of those events tightened the market for energy and we have experienced a sustained increase in the price of energy that is not clearly supported by market fundamentals.

This seems like precisely the kind of thing that the FED should not be jumping at.

Posted by

Karl Smith

at

10:54 AM

5

comments

![]()

Agflation not Oil Prices

More of my colleagues are agreeing with me that no cut would be the right move, even if they think the FED might cave to market pressure this time.

Many, however, mention rising oil prices as a concern. I don't see that. First, as far as I can tell crude is in a slight bubble. Crack spreads are declining and some of the smartest players are becoming at a minimum less long crude and probably starting to take out short positions. At a minimum crude's upward swing is limited by Saudi fears of letting the alternative energy genie out of her bottle. There is reason to believe that basic R&D is the big stumbling block here and $100 crude will interest a lot of alternative energy venture capitalists.

Agricultural prices are a different beast. Not to put too fine of a point on it, but remember when you were supposed to finish your dinner because of all those starving kids in China? Well they're not starving any more. They are out bidding you.

Couple that with the demand for bio-fuels, increased transportation costs and climatic instability and I see a recipe for sustained increases in food costs over the coming 2 - 5 years. While these forces are not monetary in nature it is hard to refer to a sustained increase in the price of a basket of goods as something other than inflation.

The FED will have to respond to this secular trend in a effort to manage inflation expectations even if they know that the fundamentals are ultimately transitory.

Posted by

Karl Smith

at

9:32 AM

1 comments

![]()

Saturday, October 27, 2007

Stand Pat

Not much time recently. I wanted, however, to make a note of my thoughts on FED policy ahead of next weeks meeting. As I mentioned before I have been consistently more hawkish than the Bernanke or Greenspan Feds.

Last time I called for 50 bps, with another 25 in Oct based on where the data was trending.

The data did not, however, unfold as negatively as I had guessed. My stance would be to hold on Oct. and wait for the data to cut again, possibly another 50 bps in December.

Part of my reasoning is that we do not in fact have enough data to justify a cut, and partly because the thinking on Wall Street has evolved into believing there is a FED put. While balancing inflation expectations and unemployment should always be the FEDs predominant concern, efforts should be taken to relieve the moral hazard posed by presumptions that the FED is "pro-stock market." This provides the perfect opportunity to accomplish both goals.

I would say something to the effect of:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 4-3/4 percent.

While trends in the consumer real estate remain negative and the outlook for overall growth is slightly below potential, financial markets have stabilized considerably since the summer.

Recent readings on inflation have been promising and core inflation has moderated as expected. However, headline inflation readings remain elevated and there are concerns that secular trends in agricultural prices will begin to raise inflation expectations.

While risks to both inflation and output remain, the committee's predominant concern is that an acceleration in the housing correction could contribute to protracted weakness in US growth rates. The committee will monitor data as it comes in and is prepared to act, rapidly if necessary, in response to significant deterioration in output and employment.

Posted by

Karl Smith

at

12:43 PM

1 comments

![]()

Thursday, October 18, 2007

Is This A Picture of The Bank Lending Channel

One line of reasoning suggests that business cycles are really credit worthiness cycles. That in good times ever more shaky borrowers are allowed access to credit. At some point the credit bubble pops, lending standards rise dramatically and the economy slides into recession.

Looking at the above picture on subprime delinquencies are we seeing just that. A sharp decline in delquinacies in 2003 as the recovery took hold and then a big increase in 2006 -2007 as the economy begins to slide back towards recession.

Of course the other explanation is that economic conditions are driving the delinquencies but then how do you explain that they seem to lead the job market? For example, jobs were still soft in 2003 when delinquencies were low and the market is just now softening though delinquencies have risen.

Posted by

Karl Smith

at

11:32 AM

4

comments

![]()

What Good is Mechanism Design

Arnold Kling and Tyler Cowen pooh-pooh the work that won the latest Nobel Prize in Economics. I tend to stand more in line with Alex Tabarrok who credits mechanism design with inducing a greater appreciation of markets.

More broadly I would say that Incentive Compatibility Constraints (ICC) are the theoretical nail in the coffin for socialism. When I talk with serious socialists, and yes they do exists, ICC is always the backbone of my arguement.

Yes, the market does badly I say - but the question is whether it is even theoretically possible to do better. The sophisticated socialists tends to believe that current incarnations are a bogus and that are more through, scientifically designed socialism would be more successful.

Incentive compatibility constraints show why that it is unlikely.

They also help us out of conspiracy theory traps and frightening pop fiction. The problem I always say with 1984 is that it completely ignores any semblance of incentive compatibility. In what sense is the politics of 1984 consistent with a law enforcement structure that pursues its own personal interests? Who enforces the law upon the enforcers? And the who enforces the law upon them and why don't they all just collude?

Lastly, however, ICC gives a window of insight into dictatorship and helps us think through why claims that Iraqi people must uniformly welcome the US as liberators. If they all hated Saddam then by what means was Saddam maintaining power. All successful power structures must be incentive compatible. There must be some reason why it is not in the best interests of the generals to lead a coup.

That reason is going to be key in establishing a successful government.

Posted by

Karl Smith

at

11:32 AM

18

comments

![]()

Monday, October 8, 2007

The Malthusian Regime

I am late to a debate going on between Bryan Caplan and Greg Clark over the Malthusian Regime. Bryan essentially takes the stance that decreases in population should not be seen as key in raising the standard of living. Presumably because of increasing returns to scale in the production of technology.

However, it seems straight forward to me that that increasing returns in one factor of production are temporarily outweighed by decreasing returns in another. Overtime as technology accumulates the overall functional form moves from decreasing to increasing returns. That shift represents the transition from the malthusian regime to the modern epoch.

Below is a simple numerical example of this type of thing. Income is a constant returns to scale function in technology(we are thinking of ever more advanced capital), labor, and land.

Technology does not depreciate and its accumulation rate is increasing in the total population level. The population grows a steady 2%. Land is fixed.

At first income per capita is decreasing because land is fixed. However, eventually enough technology accumulates that its increasing returns production dominates the fixed quantity of land.

One has to remember, however, that population effects the growth rate of technology, not its level and that the underlying capital accumulation is driven by income, perhaps even income per capita if you consider minimum consumption constraints.

Therefore, it is possible that far from delaying the industrial revolution the black death brought on the industrial revolution by increasing per capita income at a high level of technology.

Basically what helps in this model is to build up a big population to increase the technology level and then to wipe a bunch of them out to increase income per capita. The historically unusual combination of technology and wealth will rocket you forward.

Posted by

Karl Smith

at

1:46 PM

7

comments

![]()

How Good was the Sep NFP Release

On the one hand July was revised up 25K, August up 93K and Sept came in at 110K for a total of 228K more jobs than we would have thought the day before. On the other hand the March 2007 Benchmark revision slashed 257K jobs - leaving the overall level of jobs 17K less than we would have thought.

On net it is roughly a wash.

However, I would suggest that the sizable downward benchmark revision is not the best sign. The BLS methodology produces considerable inertia in the estimates. The birth death model creates or destroys jobs based on how well the monthly data performed in relation the benchmark last time around.

The upshot is that the NFP report will tend to miss turning points. Indeed, if the turning points are close together in time the the methodology should significatly amplify the peaks and troughs.

If the benchmark March 2007 was already revising jobs downward then that implies to me that the turning point was likely sometime before that. Thus all of our estimates until the new benchmarking comes into effect will be overshoots.

Moreover, there is reason to think the economy has weakened since

March 2007 and that our overshoots are actually accelerating. It will be interesting to see how the unemployment rate fairs by the beginning of 2008.

Posted by

Karl Smith

at

8:56 AM

2

comments

![]()

Friday, October 5, 2007

Dead Wrong

Both September NFP and the August revision were well off my predictions. The overall benchmark adjustments were in line. That is, job growth was significantly weaker this year than reported. As a result the BLS data is now roughly in line with ADP.

My confidence in a Oct rate cut has dropped significantly. More later.

Posted by

Karl Smith

at

2:10 PM

4

comments

![]()

Thursday, October 4, 2007

NFP to be lower than Expected - BLS is playing catch-up

My non-model guess is 50K new jobs created.

See Calculated Risk on a good chart showing BLS vs ADP estimates of private employment. The ADP report shows less volitionality and there is reason to believe that BLS has overshot the peak. To date BLS is reporting 200K more private jobs than ADP. I expect that the BLS report will be playing catch up in the coming months.

Posted by

Karl Smith

at

11:39 AM

2

comments

![]()

Friday, September 28, 2007

Whose Afriad of the Falling Dollar

There is plenty of hang wringing over what a weaker dollar portends for the US. Will it impoverish us? Reduce us to third-world status? End the US growth machine.

I am perhaps alone in thinking its one of the best things that could happen to the US. The big problem for America going forward is not growth. Its not entitlement spending. As much as I bemoan it, its not even directly our poor K12 educational system.

Its that an America with a strong university system, a strong financial infrastructure and a strong dollar has little use for strong backs. In the long run that's a good thing, but in the long run we are all dead.

Today, its a heartbreaker.

Its heartbreaking to see Americans who just don't have the financial or intellectual capital to compete in modern America fall behind.

Its also scary.

Its scary to see protectionist sentiment rise and the spectre of class warfare haunt Capitol Hill.

A falling dollar could change that. It could make American industry competitive. It will unwind the growing current account deficit - a process that while not without pain is also not without merit. It would not be such a bad thing for those of us who have done well to cut back in favor of gains among the working class.

And, it would be a great thing for that to happen through natural market mechanisms than government regulation or ill fated attempts at moral suasion.

Posted by

Karl Smith

at

6:52 PM

4

comments

![]()